Credit Cards

One of the easiest ways to build credit as a new international student inside the US is with a credit card. Using a credit card responsibly is a simple way to build and maintain a good credit score. Credit cards are now used as widely as (if not more than) cash in the US, making it almost obligatory to own one. Not having a credit card can make it difficult, if not impossible to do certain things like buy things online and rent a car.

The best way to build credit with a credit card is to use it for your daily purchases and pay off your charges each month or week. This will allow you to have regular use of the card, and steady payments- both of which lenders like to see. To ensure you never miss a payment (and harm your credit score), create an automatic payment for the minimum due each month. You can then manually pay the difference of what you’ve spent on the card.

Although having a credit card during your studies in the US is important, it can be difficult to find a company that will allow you to open a credit card as a new international student- especially if you don’t have a social security number or credit history. However, it is possible to find companies, like Deserve, that will allow you to open a credit card as an international student.

Deserve is a company built by former international students, so they know what students like you need. Students who are at least 18 years old, have been accepted to study at an accredited US college or university, and have a valid F1, J1 or M1 visa are able to apply for a credit card through Deserve.

Deserve is a company built by former international students, so they know what students like you need. Students who are at least 18 years old, have been accepted to study at an accredited US college or university, and have a valid F1, J1 or M1 visa are able to apply for a credit card through Deserve.

Deserve provides international students like you with the opportunity to have a credit card, even if you don’t have a social security number or credit history. With the Deserve Edu MasterCard you can count on the following:

- No SSN required for International students

- Amazon Prime Student Membership (get reimbursed for subscription fees up to a lifetime total of $59)

- 1% unlimited cash back on all purchases

- Credit limits up to $5,000

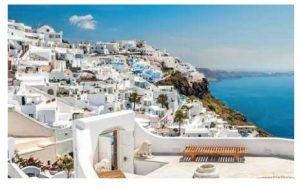

- $0 annual fee & no foreign transaction fees (great when traveling during Spring and Summer break)

- No security deposit or co-signer required

- Helps students build credit history and gain financial independence

- Use anywhere in the world where Mastercard is accepted

- Includes Mastercard Platinum Benefits like Car Rental Collision Damage Waiver, Roadside Assistance, Travel Assistance Services, Price Protection, Extended Warranty and ID Theft Protection

- Complimentary cellphone insurance up to $600